by reuters — The government last week effectively cut fuel subsidies as Lebanon grapples with a catastrophic economic collapse that has sunk its currency by more than 90% in less than two years. The energy ministry said the average price of 20 litres of 95-octane gasoline was increased by 35% to 61,100 pounds. That is […]

by Soraya Ebrahimi — thenationalnews.com — The Lebanese Army will start offering tourists helicopter joyrides this week in a bid to fill the coffers of one of the crisis-hit country’s key institutions. Lebanon’s economic crisis — which the World Bank describes as possibly one of the world’s worst since the 1850s — has hit the Lebanese […]

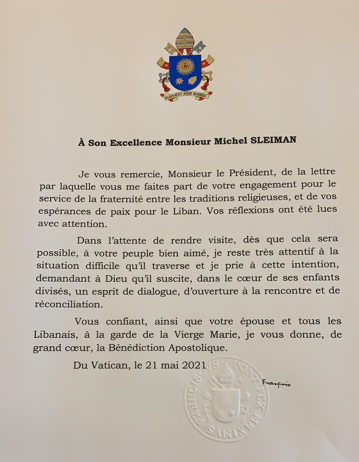

هل يبدأتصويب بوصلة المسيحيين في لقاء الفاتيكان؟

في خضمّ الاضطرابات على الساحة الاقليمية والبحث الجاري عن تفاهمات دولية لتقاسم النفوذ وحماية مصالح اللاعبين الأمَمِيّن، يتخبّط لبنان في أزمات متدحرجة أدّت إلى انهيار اقتصاده وإلى فشل إدارته السياسيّة.

في ظلّ هذا الانهيار العائد بمعظمه إلى فقدان سيادة الدولة على اراضيها وكذلك على شؤونها السياسية والحياتية، تطغى على المواطنين حالة قلقٍ على الهويّة والمصير ويمضي الجميع في البحث عن حلول للحفاظ على هذه الهويّة والتعدّدية، تتراوح من الحياد الناشط التي زُرعت أساساته في إعلان بعبدا 2012 إلى المطالبة بعقد مؤتمر دولي للاتفاق على هذا الحياد، وفقًا لمبادرة البطريرك الانقاذية. هذا الاهتمام الدولي المطلوب شهد بداياته عامي 2012 و 2013 من خلال تبني الأمم المتّحدة إعلان بعبدا كوثيقةٍ رسمية، كما ومن خلال إطلاق المجموعة الدولية لدعم لبنان في نيويورك التي بنيت على هذا الاعلان، وذلك تحت رعاية الامم المتحدة وبمشاركة الدول الخمس زائد المانيا وايطاليا والبنك الدولي والجامعة العربية والاتحاد الاوروبي. أمّا في الداخل، وبحجّة حماية حقوق المسيحيين والمحافظة على التعدّدية، فتتزاحم المشاريع السياسيّة والاقتصاديّة وبدلاً من اللامركزية الادارية تطرح الفيدرالية التي من شأنها أن تزيد من عزلة المسيحيين وتلغي دورهم في بقاء لبنان وطن رسالة، كما يدعو بعض انصار “المسيحية المشرقية” إلى تحالف الأقلّيات ما يدفع بالمسيحيين الى الابتعاد عن قضايا اوطانهم القومية او الانخراط في محاور الممانعة وصراعاتها المدمّرة أو اللجوء مستقبلاً إلى الحماية العسكرية الأجنبية أو إلى التماهي مع الأنظمة غير العادلة والمتسلّطة الامر الذي يَسْتَبْطِنُ مشروع عداوة مع الشعوب خاصّة العربية منها ويتناقض مع روح الدين المسيحي الرافض لأي قهر وظلامية و ظلم.

By Aya Iskandarani — thenationalnews.com — Lebanese authorities released two western journalists on Monday, six hours after Hezbollah detained them and handed them over to the security forces. British reporter Matt Kynaston was detained and his phone confiscated after he went to the Hezbollah-controlled southern suburb of Beirut to cover the country’s ongoing fuel crisis, his editor-in-chief at NOW Lebanon said on Twitter. “Journalist Matt Kynaston has been detained on the Airport Road by men who introduced as Hezbollah agents,” Ana Maria Luca said on Twitter. “Before his phone was probably taken away he sent a voice note with a recording of a man saying, ‘I have the right to take his phone. I have the right to take his phone without his consent.'”

Kynaston is employed at NOW Lebanon and has previously worked for The National as a freelancer. He was detained with German reporter Stella Manner, Luca said. The two journalists were handed over to Lebanese authorities and held at the General Security building in Beirut before being released in the evening. Lebanon has long been considered a haven for freedom of speech in the Middle East. But Hezbollah and its Shiite ally Amal have repeatedly cracked down on journalists, activists and demonstrators in Beirut and southern Lebanon after the mass anti-government protest movement of October 2019. Areas under Hezbollah control are out of reach for the Lebanese state. Journalists and media workers are required to ask for permission from Hezbollah before they can report from these areas. “The individual had not asked permission before filming in Dahiye,” a Hezbollah representative told The National. “That may be why he was questioned.”

من مقال يحيى احمد الكعكي اليوم في الشرق: ولكن مع استمرار رفض “البعض” في لبنان لـ”الميثاق الوطني 1943″، و”القانون الدستوري 1990/9/21″، و”إعلان بعبدا 2012″ ، و”مذكرة بكركي” 2014/2/9، ومعهم جميعًا “مسلمات دار الفتوى” 1989/9/21 ، فإنّ “لبنان الكبير” الذي أعلن عنه في 1920/8/31 سيبقى في “أزمة وجود”..!

منيت أحزاب السلطة في لبنان بالهزيمة في انتخابات نقابة المهندسين في بيروت التي نظمت الأحد، أمام مرشحين محسوبين على ما يسمى “قوى 17 تشرين”، التي تقود التظاهرات الاحتجاجية منذ عام 2019.

ويعد هذا مؤشرا يدق ناقوس الخطر بالنسبة إلى الأحزاب التقليدية المهيمنة، قبل عام من فتح صناديق الاقتراع للانتخابات البرلمانية.

وأعلنت لائحة “النقابة تنتفض” التي تمثل مرشحي المعارضة، فوزها في انتخابات الأحد، التي تعتبر المرحلة الأولى من انتخابات نقابة المهندسين، على أن تجرى “المعركة الأكبر” في انتخابات النقيب والأعضاء العشرة لمجلس النقابة في 18 يوليو المقبل.

وأعلنت اللائحة على موقعها على “تويتر” أن “النقابة انتفضت… فانتصرت”

By Nadim Shehadi — arabnews.com — In the Latin American city of Bogota, a prosperous-looking lady goes to an ATM to withdraw cash and her card is rejected. This is how, in the fall of 2019, the widow of a Lebanese immigrant in Colombia first learned of Lebanon’s financial collapse and the bankruptcy of both its banking and public sectors. Financial collapse strikes like a thunderbolt. Those affected emerge confused and disoriented, hardly realizing what hit them. Economic problems can also have financial repercussions. Unsurprisingly, there is a chicken and egg debate about this among economists: Do real economic factors affect financial phenomena, or is it monetary and financial considerations that affect the real economy? Whatever the answer is, the fact remains that, behind financial phenomena, there exists real economic factors. For example, the 2008 collapse in the US was caused by a “real” economic factor: Bad loans, known as “subprime.” Bankers created complex instruments to reduce their risk and spread these globally. When the crisis hit, it dragged everyone down with it and people are still figuring out what struck them.

In Lebanon, the banking sector gave loans to the Banque du Liban (BDL) central bank that, in turn, lent the money to the government, which kept increasing its debt to pay the interest. Bankers are easy to blame, and probably deserve it; the other side of the story is what happens in the economy and drives the crisis. This is in a country that historically operated a budget surplus and had a sound monetary policy, with risk-averse bankers. What the BDL did is no different from what the Federal Reserve and the Treasury Department are now doing in the US, with the trillions of dollars being printed and buying their own bonds. In any other economy, what would follow would be a race between economic recovery and debt servicing to make the latter sustainable. But in the US the government can print dollars as it pleases and feed its own Ponzi scheme indefinitely, as long as the US dollar is the global reserve currency. There is no banking system that can survive a run and, once it happens, it is unstoppable. A run on a bank is when depositors rush to withdraw their money at the same time. It is caused by a sudden loss of confidence. This is what happened in Lebanon after November 2017.

by BY CAROLINE VAKIL — thehill.com — Lebanese troops were deployed to Tripoli on Sunday following protests over Lebanon’s worsening economic conditions that left 10 soldiers and several protesters injured the night before, The Associated Press reported. Protests and riots in the cities of Sidon and Tripoli on Saturday stem from the country’s economic crisis […]

By NAJIA HOUSSARI — arabnews.com — BEIRUT: Lebanese authorities have rejected suggestions that the country is planning to import oil from Iran amid a worsening energy and currency crisis. Lebanon’s energy ministry on Saturday said that it had received no requests for a “permit, either from an official or private party, to import oil from Iran.” The official Lebanese response followed a tweet by the Iranian Embassy in Beirut saying that “the arrival of Iranian oil tankers does not need the attention of the US ambassador.” The embassy warned the US envoy not to intervene “in the brotherly relations between the Iranian and Lebanese peoples.” A photo of an oil tanker at sea was attached to the tweet. The tweet heightened speculation about the imminent arrival of an Iranian tanker in Beirut port following a proposal by Hezbollah that Lebanon look to oil imports from Iran. On Friday, the US envoy in Lebanon, Dorothy Shea, told a local television station that importing fuel oil from Iran “is not a practical solution.” She added: “What Iran is looking for is a sort of dependent state that it can use to carry out its agenda. There are much better solutions than turning to Iran.” She added: “The US has always been by the side of the Lebanese people, but Iran looks at Lebanon as being a state that could help it implement its agenda.”

Hezbollah chief Hassan Nasrallah said that his party is “working in the background to implement a plan to buy oil from Tehran and pay for it in Lebanese pounds.” He proposed that two oil refineries be built in north and south Lebanon. The Hezbollah proposal provoked widespread anger, with former MP Ahmad Fatfat claiming that “Iran wants to keep Lebanon as a card in its hand to use later.” He said that Lebanon’s economic collapse has allowed Hezbollah to “get its hands on all sectors,” while its ally the Free Patriotic Movement (FPM) “has handed the party all the cards in return for getting power.” Political analyst Assaad Bechara told Arab News that Nasrallah’s insistence on importing oil from Iran “is a populist step that aims to suggest Iran is helping Lebanon while the rest of the world is doing nothing.” However, he questioned whether Lebanon’s private sector companies would be willing to risk sanctions by importing Iranian oil. “The queues at gas stations in Tehran are longer than the queues in Lebanon,” he added. Attempts to strengthen Iranian influence over Lebanon are unfolding amid a worsening financial collapse, with the exchange rate late on Saturday reaching 18,000 Lebanese pounds to the dollar.

ان كثرة التفاهمات والمصالحات وبيانات التهدئة والتوضيح والاستنكار رغم ضرورتها هي اكبر دليل ان المجتمع ليس بخير