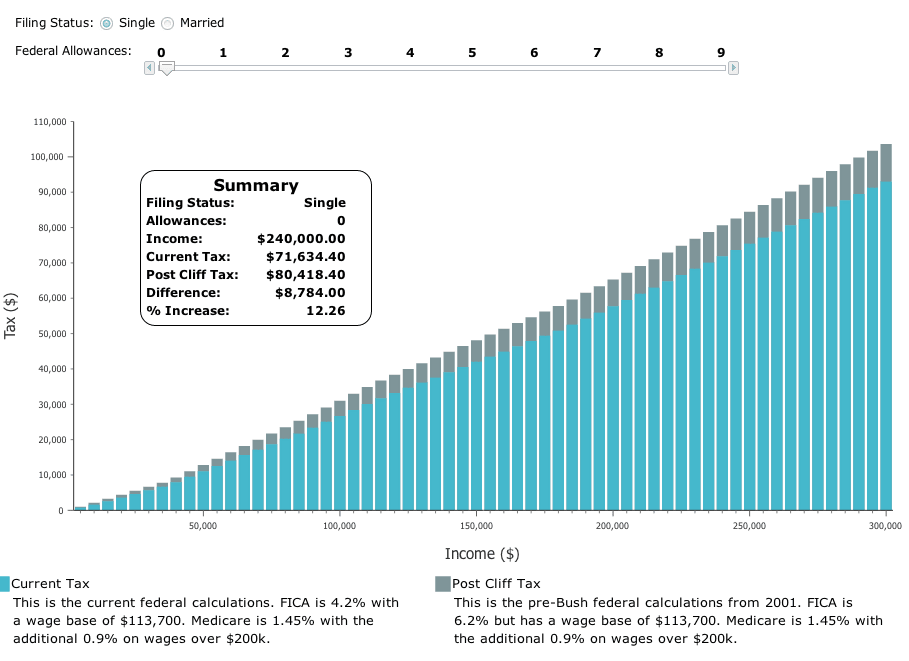

With all the drama and uncertainty surrounding the pending Fiscal Cliff, all consumers really want to know is how much they should be worrying about their own paycheck.

The reality is that every single one of the 160 million wage earners in the U.S. could be impacted if these tax changes go through –– just not exactly all to the same degree.

To help, payroll and tax software specialist Symmetry Software has created a new tool that gives you a clear picture of how your paycheck will look on both sides of the cliff.

Click the image in this post to be taken to the tool. Read on if you’re curious as to how it actually works.

-To see the potential increase in the amount of federal tax that will come out of a paycheck, select a filing status from the Form W-4 (single or married,) and the number of federal allowances claimed.

-Hover the mouse over the bar that corresponds to the approximate income level.

-Check the summary window to see the estimated impact the fiscal cliff could possibly have on the amount of federal taxes withheld from a paycheck.

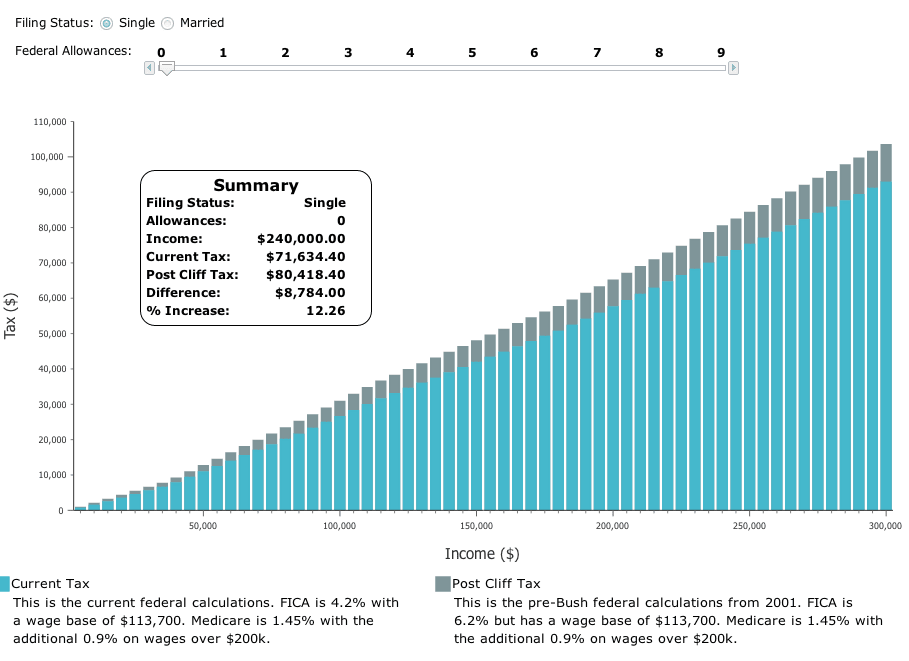

With all the drama and uncertainty surrounding the pending Fiscal Cliff, all consumers really want to know is how much they should be worrying about their own paycheck.

The reality is that every single one of the 160 million wage earners in the U.S. could be impacted if these tax changes go through –– just not exactly all to the same degree.

To help, payroll and tax software specialist Symmetry Software has created a new tool that gives you a clear picture of how your paycheck will look on both sides of the cliff.

Click the image in this post to be taken to the tool. Read on if you’re curious as to how it actually works.

-To see the potential increase in the amount of federal tax that will come out of a paycheck, select a filing status from the Form W-4 (single or married,) and the number of federal allowances claimed.

-Hover the mouse over the bar that corresponds to the approximate income level.

-Check the summary window to see the estimated impact the fiscal cliff could possibly have on the amount of federal taxes withheld from a paycheck.

Read more: http://www.businessinsider.com/how-fiscal-cliff-affects-paychecks-2012-11#ixzz2CL0yb039

With all the drama and uncertainty surrounding the pending Fiscal Cliff, all consumers really want to know is how much they should be worrying about their own paycheck.

The reality is that every single one of the 160 million wage earners in the U.S. could be impacted if these tax changes go through –– just not exactly all to the same degree.

To help, payroll and tax software specialist Symmetry Software has created a new tool that gives you a clear picture of how your paycheck will look on both sides of the cliff.

Click the image in this post to be taken to the tool. Read on if you’re curious as to how it actually works.

-To see the potential increase in the amount of federal tax that will come out of a paycheck, select a filing status from the Form W-4 (single or married,) and the number of federal allowances claimed.

-Hover the mouse over the bar that corresponds to the approximate income level.

-Check the summary window to see the estimated impact the fiscal cliff could possibly have on the amount of federal taxes withheld from a paycheck.

Read more: http://www.businessinsider.com/how-fiscal-cliff-affects-paychecks-2012-11#ixzz2CL0yb039