نقلت صحيفة "السفير" الرواية المعممة من قبل "فرع المعلومات" بشأن قضية توقيف الوزير والنائب السابق ميشال سماحة على خلفية اعداد تفجيرات …

سجل الوزير السابق فريد هيكل الخازن في تصريح اليوم ملاحظاته على مشروع الانتخاب الذي أقرته الحكومة، فقال: " في الشكل إن …

are renowned for innovation, phenomenal growth, and, in the case of public corporations, their soaring share prices. Google Inc. (NASDAQ: GOOG) usually makes the list, as does Apple Inc. (NASDAQ: AAPL). At the other end of the scale are well-known firms that are so crippled they go bankrupt or disappear entirely. Recently, these have included AMR, the parent of American Airlines, Borders, and Eastman Kodak.

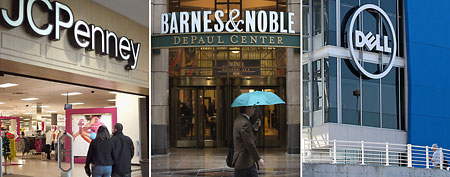

1. J.C. Penney Company Inc. (NYSE: JCP)

J.C. Penney, founded in 1913, counted itself among the primary retailers and catalog companies in the US for decades. But under CEO Myron Ullman III, who took over in 2004, its revenue began to slide, dropping from $19.9 billion in 2007 to $17.3 billion in 2011. Earnings fell from $1.1 billion to a loss of $152 million in the same period. J.C. Penney’s share price has fallen 70% in five years. By way of contrast, the shares of Macy’s Inc. (NYSE: M) and Target Corp. (NYSE: TGT) — two direct competitors — have been essentially flat over the same period. J.C. Penney was challenged by these two companies and several others, including Wal-Mart Stores Inc. (NYSE: WMT) and Costco Wholesale Corp. (NASDAQ: COST). Problems became so severe that J.C. Penney closed its formerly successful catalog business and reached outside for a new CEO. The board’s choice was Apple Retail Chief Ron Johnson, who was picked in June 2011. Johnson changed the company’s pricing structure, but the reaction was so poor that revenue dropped an extraordinary 20.1% to $3.2 billion in the first fiscal quarter. J.C. Penney posted a loss of $163 million. Internet sales, so essential in a world in which Amazon.com Inc. (NASDAQ: AMZN) has become a significant presence, fell 27.9% to $271 million. By contrast, Macy’s total sales, combining online and those made in stores, rose 4.3% to $6.1 billion in the last reported quarter. And Macy’s is hardly J.C. Penney’s largest competitor by revenue or workforce. Walmart’s sales were $450 billion last year, while Costco’s were $89 billion.

2. The New York Times Co. (NYSE: NYT)

The New York Times is, and has been for decades, the premier daily newspaper company in the US. But the company has been shrinking rapidly. Ten years ago, The New York Times Company made $300 million on revenue of $3.1 billion. Last year it lost $40 million on revenue of $2.3 billion. The New York Times did not move online fast enough to offset the rapid erosion of print advertising. Its tardiness allowed it to be challenged on the Internet by properties like The Huffington Post, Google News, and the news, sports, and financial properties of portals such as MSN, AOL, and Yahoo!. As an indication of how the stock market measures the value of The New York Times Company, its market cap is $1.2 billion against its revenue of $2.3 billion in 2011. Low-brow content aggregator Demand Media has a market capitalization of $865 million against 2011 revenue of $325 million. Demand lost $13 million last year. The reason the market values of the two companies are so close? The Times still relies on the dying print business for the lion’s share of its revenue. Its market cap and cash balance are too low to allow it to more aggressively move to the internet or buy large online properties. In the last quarter, The Times’ revenue was roughly flat at $515 million. The company lost 57 cents a share compared with a profit of 5 cents a share in the same period last year. The worst news from the quarter was that “Digital advertising revenues at the News Media Group decreased 1.6 percent to $52.6 million from $53.5 million mainly due to declines in national display and real estate classified advertising revenues.” The Times did make advances in online paid subscriptions, but circulation revenue barely offset the drop in advertising sales. At the heart of The New York Times’ uniqueness among American newspapers is the quality of its editorial content. The company has held the line on retaining its large editorial staff. It did lay off 100 people in 2009, which was about 8% of the news staff. The industry is in the midst of another wave of job cuts. The Times has not been able to show significant top-line growth, even with its digital subscription efforts. Print is in too much of a shambles for the company to shore itself up in the digital world.

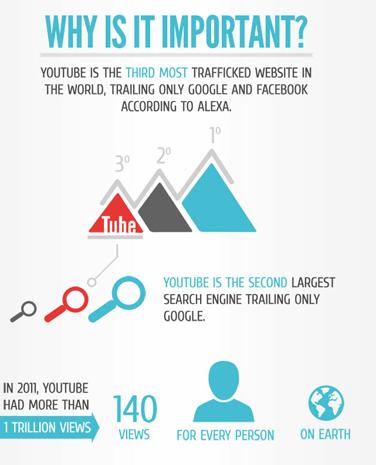

YouTube is the third most trafficked website in the world, after Google and Facebook, and if your company isn’t using the online video site as part of your social recruitment efforts you’ll want to start after checking out this infographic from HireRabbit.

The HireRabbit infographic, YouTube Recruiting, takes a look at why making YouTube a part of your hiring efforts is important. We’ve gleaned a few enticing points from the infographic, which you can read on to learn more about before checking out the full infographic below.

Job postings with videos get higher response rates

The infographic reports that job postings with video icons are viewed 12 percent more than those without. Furthermore, job postings with video icons receive a 34 percent greater application rate.

Videos help you show off the personality of your company

A prospective hire can learn a lot more about what it will be like to work at your company if you upload a video showing off the personality of your workplace. Looking for inspiration on this front? Check out the Life At YouTube series that the online video site launched last year.

Videos encourage sharing more than text

Viewers are a lot more likely to share a video than they are to share text. If you encourage the sharing of your video you’ll reach even more prospective hires.

View the full infographic below to find out more, including tips for how to humanize your business using video, how to create an awesome YouTube channel, and a roundup of the top five branded career channels on YouTube. Is your company using YouTube for recruiting?

Khazen History

Historical Feature:

Churches and Monasteries of the Khazen family

St. Anthony of Padua Church in Ballouneh

Mar Abda Church in Bakaatit Kanaan

Saint Michael Church in Bkaatouta

Saint Therese Church in Qolayaat

Saint Simeon Stylites (مار سمعان العامودي) Church In Ajaltoun

Virgin Mary Church (سيدة المعونات) in Sheilé

Assumption of Mary Church in Ballouneh

1 - The sword of the Maronite Prince

2 - LES KHAZEN CONSULS DE FRANCE

3 - LES MARONITES & LES KHAZEN

4 - LES MAAN & LES KHAZEN

5 - ORIGINE DE LA FAMILLE

Population Movements to Keserwan - The Khazens and The Maans

ما جاء عن الثورة في المقاطعة الكسروانية

ثورة أهالي كسروان على المشايخ الخوازنة وأسبابها

Origins of the "Prince of Maronite" Title

Growing diversity: the Khazin sheiks and the clergy in the first decades of the 18th century

Historical Members:

Barbar Beik El Khazen [English]

Patriach Toubia Kaiss El Khazen(Biography & Life Part1 Part2) (Arabic)

Patriach Youssef Dargham El Khazen (Cont'd)

Cheikh Bishara Jafal El Khazen

Patriarch Youssef Raji El Khazen

The Martyrs Cheikh Philippe & Cheikh Farid El Khazen

Cheikh Nawfal El Khazen (Consul De France)

Cheikh Hossun El Khazen (Consul De France)

Cheikh Abou-Nawfal El Khazen (Consul De France)

Cheikh Francis Abee Nader & his son Yousef

Cheikh Abou-Kanso El Khazen (Consul De France)

Cheikh Abou Nader El Khazen

Cheikh Chafic El Khazen

Cheikh Keserwan El Khazen

Cheikh Serhal El Khazen [English]

Cheikh Rafiq El Khazen [English]

Cheikh Hanna El Khazen

Cheikha Arzi El Khazen

Marie El Khazen