by reuters — Lebanon’s cabinet will hold its first meeting in three months on Jan. 24, a Lebanese television channel reported on Monday, after a gap in which the country’s economic crisis has deepened and efforts to revive talks with the IMF have stalled. Economy Minister Amin Salam said work on the 2022 budget […]

By Najia Houssari — arabnews.com — BEIRUT: A Lebanese Shiite scholar has denounced Hezbollah, as well as its leader Hassan Nasrallah and his deputy Sheikh Naim Qassem, in a sermon published on his Facebook page and shared across social media. Sheikh Abdul Salam Dandach, from the Baalbek–Hermel region, said in the video: “Our resistance is different from theirs (Hezbollah’s). We are not the rulers of this land and we are not new parties that came to Lebanon. Our parents and ancestors are deeply rooted in this land.” The party is referred to as the “resistance” in Lebanon. He addressed Nasrallah, saying: “You resist using deception and encroachment. You live off your resistance, based on the bliss of the US dollar, whereas our resistance comes from hunger and poverty. You resist through surfeit and ingratitude. We resist your lies. We resist the illness and ignorance that you caused in the region. We resist the destruction and havoc that you created.”

Since the beginning of the economic and social crisis that has hit Lebanon, many in the Shiite community of Baalbek–Hermel have complained about the rampant insecurity that the region is witnessing due to the emergence of a de facto power that controls people’s lives with its weapons and allows the formation of gangs involved in smuggling, kidnapping and extortion. An activist from the region, who did not reveal his identity, told Arab News: “Baalbek–Hermel doesn’t have any patron. The government has been neglecting it for years and Hezbollah tries to avoid it, turning its back on the complicated social and economic crises.” The Shiites in Baalbek–Hermel constitute 60 percent of the population, whereas the Sunnis and Christians represent 20 percent apiece. Fewer than 30 percent of the Shiites belong to political parties, mostly the Amal Movement and Hezbollah, whereas the rest belong to a clan.

By MAYSAA AJJAN — arabnews.com — BEIRUT: Lebanon’s financial woes began with the protests in October 2019, when a series of peaceful sit-ins escalated and became a national revolution against the ruling class. Soon, there was a steep decline in the value of the Lebanese pound against the dollar. The official rate is still 1,500 pounds to the dollar but the currency has lost more than 90 percent of its value and now trades at about 30,000. Meanwhile, Lebanese banks decided to withhold the savings of individuals and organizations, a decision that resulted in many residents losing their life savings and the closure of numerous organizations, family businesses and startups. “I lost $350,000 of my money because of the crisis,” Rana Chmaitelly, the founder of The Little Engineer, an educational startup for children, told Arab News. “I lost the product of my sweat, blood and tears — they took it all away. But I didn’t give up.”

In a stroke of good fortune amid the despair, toward the end of 2019 Chmaitelly was expecting a large transfer of money from a business partner. Having been denied access to the cash in her own bank account in Lebanon, her only solution was to swiftly establish an offshore, and later a freezone, company in the UAE, to which the money her partner owed her could be safely transferred. “That transfer to the UAE saved me and my team, or else we would now be owing a lot of money to our partners,” Chmaitelly said. Her story is not unique among Lebanese startups. The founders of Cherpa, another educational startup, which offers technology training courses to teenagers, also relocated in part to the UAE at the onset of the financial crisis. They were able to open a freezone company there and obtain residency. “Having our money withheld by banks was awful; there was a lot of frustration,” cofounder Bassel Jalaleddine, told Arab News. “I used to waste my time queuing up in banks all day just to get $300.” Online platforms Mint Basel Market, Kamkalima and Ounousa are just some of the other startups that relocated operations, at least partly, to the UAE.

احد مبارك مهما كانت الاسباب الكامنة وراء اعلان حزب الله وامل مشاركتهما في جلسات الحكومة ( لاجل اقرار الموازنة فقط! او دون شروط؟ ) فهو موقف مفيد وواجب. اكان السبب هو فقدان نصاب الهيئة العامة لمحكمة التمييز ام الحاجة الى اقرار المساعدات الاجتماعية وبدل النقل للموظفين ام غير ذلك فهو موقف جيد. لكن من المؤكد […]

Doha: A plane from the Amiri Air Force of the Qatari Armed Forces loaded with 70 tons of food, representing a new shipment of food aid provided by the State of Qatar to the army in the sisterly Lebanese Republic of Lebanon, arrived today at Rafic Hariri International Airport. The State of Qatar announced last […]

by reuters — Powerful Lebanese groups Hezbollah and Amal have said they would end a boycott of cabinet sessions, opening the way for ministers to meet after a three-month gap that has seen the economy and currency collapse further. The groups, which back several ministers in a government made up of members from across the political spectrum, said in a statement on Saturday that the decision was driven by a desire to approve the 2022 budget and to discuss an economic recovery. The Lebanese cabinet under Prime Minister Najib Mikati has not met since October 12 due to squabbling about the investigation into the deadly Beirut port explosion in August 2020, and a continuing diplomatic rift with Saudi Arabia and some Gulf states. As a result, the government has been unable to take swift action to address the country’s dire economic crisis.

Since August 2019, the Lebanese pound has lost more than 90 percent of its value as more than three-quarters of the population has slipped into poverty. The country’s inflation rate has exceeded those of crisis-hit Venezuela and Zimbabwe. The World Bank has said the Lebanese financial crisis is one of the worst since the mid-19th century. In December, President Michel Aoun said Lebanon needs “six to seven years” to emerge from the crisis. The economic meltdown began in 2019 when the financial system collapsed under the weight of huge state debt and lack of foreign currency – the result of decades of corruption, economic mismanagement, and unsustainable financing.

تعليق المشاركة في جلسات مجلس الوزراء، حق ديمقراطي مقاطعة جلسات انتخاب رئيس الجمهورية لمدة سنتين ونصف ، ايضاً حق ديمقراطي تعطيل نصاب جلسات مجلس النواب التشريعية هو حق من الحقوق الديمقراطية نظرياً … صح هذه حقوق ديمقراطية عملياً … ديمقراطية بدون ديمقراطيين

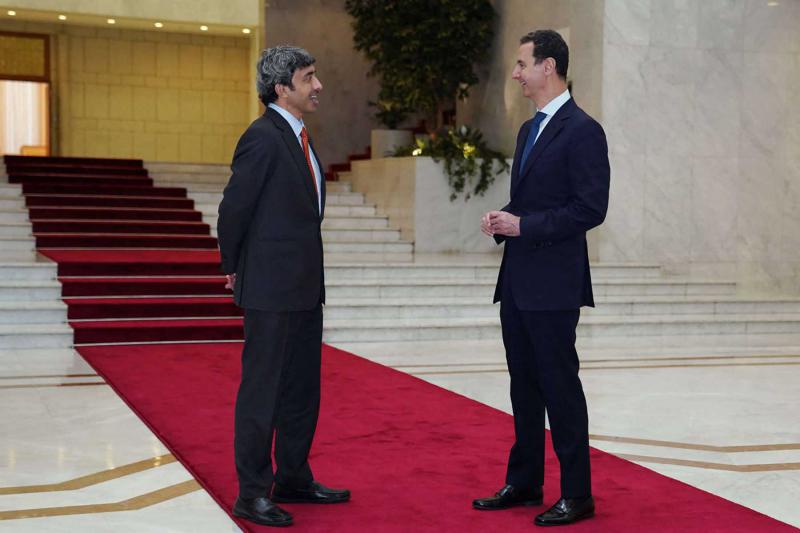

Syria’s President Bashar al-Assad (R) talks to UAE Foreign Minister Sheikh Abdullah bin Zayed Al-Nahyan in the capital Damascus, November 9, 2021. (AFP)

by thearabweekly.com — Israel sees benefits in terms of curtailing Iranian influence in Syria arising from the Gulf states’ progress towards normalisation with the Damascus regime, said an Israeli media report quoting “a senior diplomatic official” in the Jewish state. The unnamed source, cited by Israeli news website Ynet, said that closer ties to Arab Sunni states might indicate a willingness on the part of the Syrian regime to curb relations with Iran and Shia allies. “During the coming year there will be opportunities to reduce the Iranian presence in Syria,” predicted the Israeli official. The Israeli source highlighted the importance of the economic factor as the rapprochement between Damascus and Gulf countries could help Syria deal with its financial crunch and shore up the stability of the regime. Syria faces a tough economic crisis due to war-related expenditures and US and European restrictions.

The Israeli official described Iran’s nuclear programme as “a great threat to Israel, even an existential threat” and the development of an atomic weapon by Iran would “exacerbate the terror activities of its proxies in the area.” The source did not rule out an Israeli strike on Iran’s nuclear facilities if the ongoing talks in Vienna do not manage to limit the threat of Israel building a nuclear bomb. But the Israeli official noted that in case of a military attack on Iran, Lebanon’s pro-Iran party Hezbollah and the Palestinian militant faction Hamas might enter the fray in support of Tehran. Hezbollah “has very significant attack capabilities that pose a challenge to us,” the Israeli source added. “We are conducting defensive preparations in the northern arena.” Israeli Prime Minister Naftali Bennett was quoted as telling the Knesset’s Foreign Affairs and Defence Committee, Monday, that Israel was conducting “a multifaceted war” against Iran and its regional proxies, especially Hezbollah and Hamas. He expressed the view that financial constraints and pressures at home limit Iran’s ability to carry out its regional designs. Since last July, a number of Arab countries has increasingly made moves to normalise relations with the Assad regime, through meetings, agreements and economic understandings. The moves involved Jordan, Egypt and the UAE, in particular.

by naharnet –– Democratic Gathering Bloc MP Hadi Abou El-Hassan, said that President Michel Aoun instead of “lecturing” the dialogue boycotters, should have addressed “his ally,” which is “the main party disrupting the country.” He added that “the one who had disrupted the country for 9 years out of his 16 years of management, shouldn’t […]

by reuters — BEIRUT: Lebanon’s central bank said on Friday it aimed to boost the Lebanese pound’s value by easing restrictions on dollar purchases after the currency hit a record low, fueling fresh protests about rising prices and a collapsing economy. The pound, which has lost more than 90 percent of its value since Lebanon’s […]