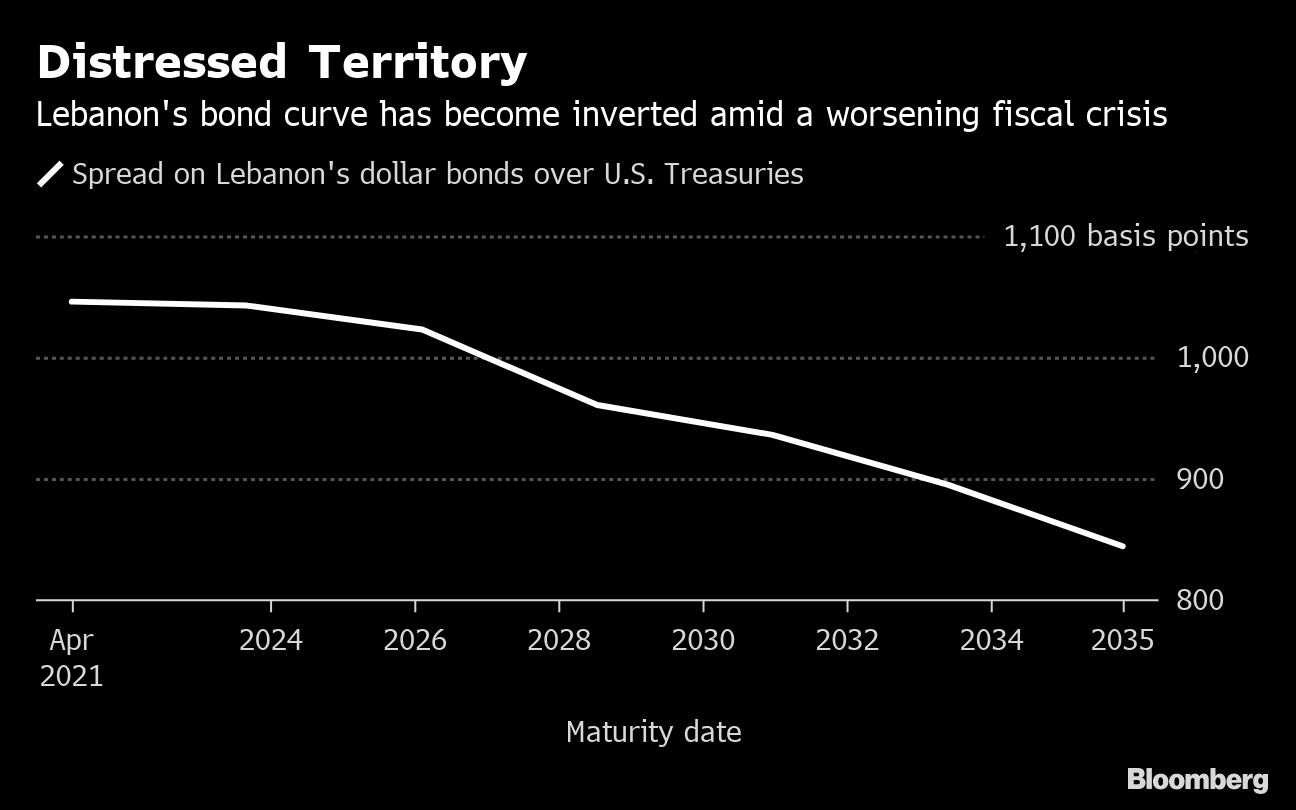

(Bloomberg) –Abeer Abu Omar and Paul Wallace– Lebanon’s Eurobonds have entered distressed territory as a budget delay and rising political tension in the region complicate efforts to tackle the nation’s fiscal crisis. The average extra yield investors demand to hold the Arab nation’s debt over U.S. Treasuries climbed to a 10-year high of 946 basis points this week. Among emerging markets not in default, only Zambia and Argentina have wider spreads, according to a Bloomberg Barclays index. Some of Lebanon’s dollar securities, including those maturing in 2022 and 2023, already have spreads above 1,000 basis points.

Investors are losing patience as political squabbles stall economic reforms. A long-delayed budget aims to lower the deficit to 7.6% of gross domestic product this year, which would help unlock billions of dollars in aid. Prime Minister Saad Hariri said last week that lawmakers objected to some items after previously agreeing to them, and he ridiculed suggestions that Lebanon would seek a bailout from the International Monetary Fund. “The country is running out of time,” said Raffaele Bertoni, the head of debt-capital markets at Gulf Investment Corp. in Kuwait City. “Unpopular decisions are needed to keep the growing fiscal deficit under control. Until then, Lebanese sovereign bonds will continue to trade in distressed territory.”